Material Flow Cost Accounting – Definition

Material Flow Cost Accounting (MFCA) is a method used by businesses to improve their material efficiency and is standardized through ISO 14051. The method specifically focuses on material losses incurred during production.

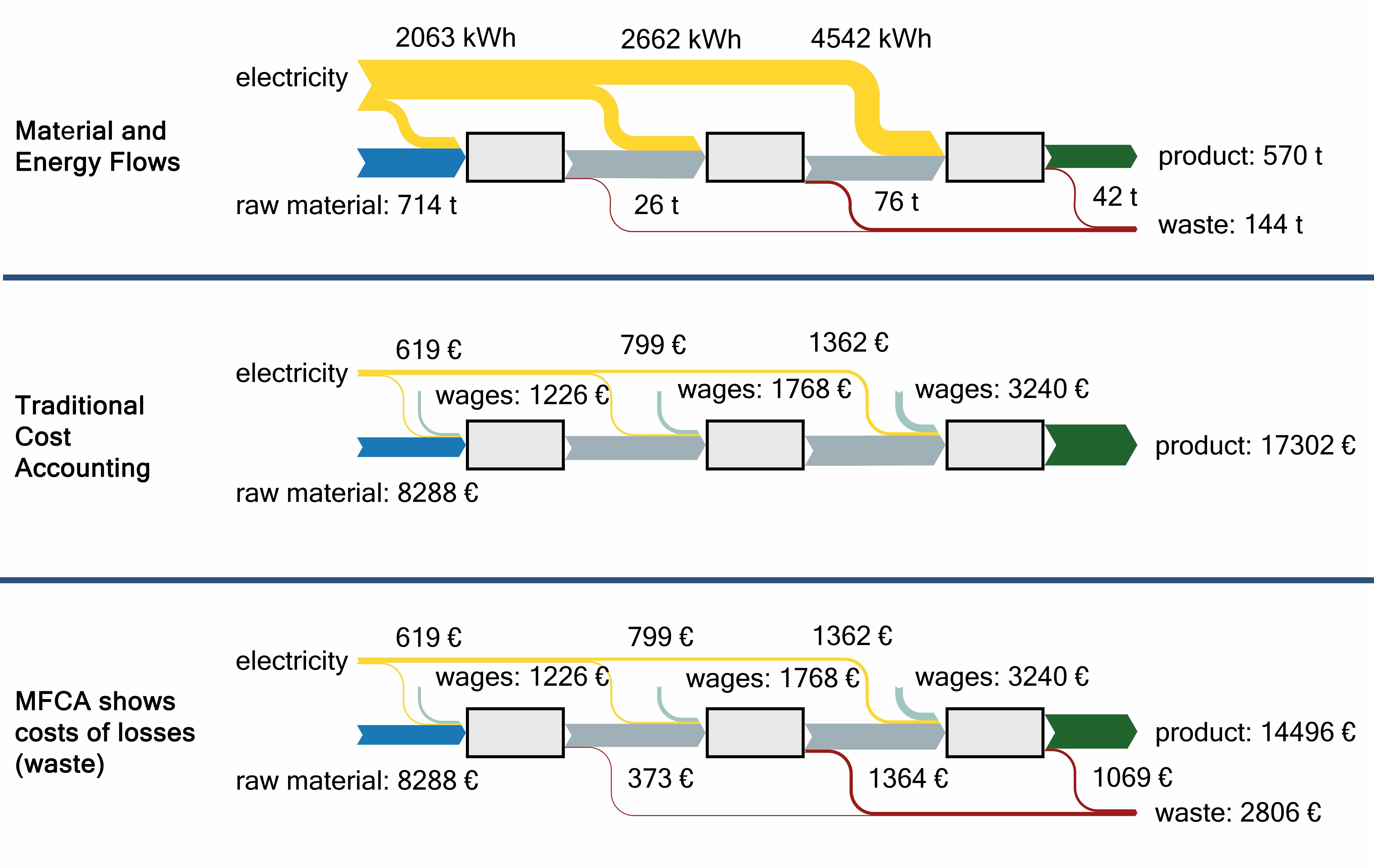

In conventional cost accounting, these losses are budgeted as waste costs or, in a best-case scenario, are allocated a market price if they can be recycled for further use. By avoiding these material losses (waste), energy, costs and CO2 emissions can be saved.

In both conventional accounting and Life Cycle Assessment (LCA), the cost for waste disposal is attributed to the product. This makes managerial sense when calculating the profit margin, for example.

Material flow cost accounting, though, takes this process one step further by proportionately isolating the energy, material, personnel, and all other overhead costs associated with the wasted material – just as you would calculate these costs for the product itself. By using this method, a true costing of material losses that includes a significantly wider range of factors is achieved. Even if you can sell wasted material as a resource, the overall loss in value is probably much higher than you assume.

Costs considered in MFCA

Conventional cost accounting

- Disposal costs

Material flow cost accounting:

- Disposal costs

Hidden costs

- Material & logistics costs

- Labor costs

- Energy costs

- Investment costs

Differences in the examination of material losses

In classic cost accounting, the costs for waste are often treated as disposal costs in a very general manner. The waste disposal costs are then assigned directly to the product. This view is useful, for example, to calculate the contribution margin.

Material Flow Cost Accounting, on the other hand, considers all costs that were incurred in the process chain before the material input became a material loss. These are hidden costs such as transport, machine use, energy as well as auxiliary and operating materials.

Even if the loss of material can be sold later as recyclable material, the loss in value will probably be higher than expected. Hence, MFCA aims to avoid losses in the first place instead of just recycling them.

More Information on MFCA

The most important basis and requirement for material flow cost accounting is a material and energy flow model that transparently displays the production processes with material and energy flows, as well as with the waste and losses. When using material flow cost accounting for a production line or an entire site, the first step is always to set up and validate this model.

The sum of all costs attributable to material loss is equal to the maximum cost savings that can be obtained in a theoretically optimal state in which there are no material losses. Another way to view these potential cost savings is as an investment budget for reducing waste. By calculating the real costs of material loss, you therefore dramatically increase the potential for optimization.

Moreover, by avoiding non-essential material and energy flows within your production processes you not only increase energy and resource efficiency but also reap the benefit of cost reduction.

The idea of Material Flow Cost Accounting was born in the 1980s. The aim was to develop an instrument to support environmental management and eco-controlling.

The method originated in Germany, but the breakthrough came in Japan. One example is the camera manufacturer Canon, which was able to save more than €30 million in material costs between 2004 and 2012 through Material Flow Cost Accounting.

Inspired by the Japanese best practice examples, more and more companies are taking a closer look at their material flows and material waste. And it's worth it, because the loss of material means lost added value, because the waste material was also purchased, processed and moved.

- Asian Productivity Organization: Manual on Material Flow Cost Accounting: ISO 14051 (2014). Available online here

- Hyršlová, J.; Vágner, M.; Palásek, J. 2011. Material Flow Cost Accounting (MFCA) – tool for the optimization of corporate production processes. Business, Management and Education 9(1): 5–18. doi:10.3846/bme.2011.01 open access article available here

- ISO 14051:2011 Environmental management - Material flow cost accounting - General framework

- Kokubu, K; Kos Silveira Campos, M; Furukawa, Y; Tachikawa, H.: Material flow cost accounting with ISO 14051.

- Kokubu, K; Kitada, H: Material flow cost accounting and existing management perspectives. In: Journal of Cleaner Production, Volume in print (2014)

- Material Flow Cost Accounting: MFCA Case Examples. Tokyo 2011. Available online here.

- Schaltegger, S; Zvezdov, D: Expanding material flow cost accounting. Framework, review and potentials. In: Journal of Cleaner Production, Volume in print (2014)

- Schmidt, A.; Hache, B.; Herold, F.; Götze, U.: Material Flow Cost Accounting with Umberto

- Schmidt, M.: The interpretation and extension of Material Flow Cost Accounting (MFCA) in the context of environmental material flow analysis. In: Journal of Cleaner Production (2014). Available here.

- Schmidt, M.; Nakajima, M.: Material Flow Cost Accounting as an Approach to Improve Resource Efficiency in Manufacturing Companies. In Resources 2013, 2, pp. 358-369; doi:10.3390/resources2030358. Open access article available online

Case Studies on Material Efficiency

Read our case studies and learn how companies use the material flow cost accounting to successfully identify optimization potential in the production process.

How we support you on MFCA and resource efficiency

Free MFCA webinar

How can you increase your material efficiency by using the MFCA method? This question will be answered in our webinar "10 success factors for the introduction of the MFCA method".

In this free and interactive webinar, MFCA expert Martina Prox outlines how manufacturing companies can increase their material efficiency through the use of Material Flow Cost Accounting. The MFCA method is the perfect first step to achieve maximum resource efficiency in your production process.

Our LCA Software

Umberto is one of the leading software solutions for material flow analysis and life cycle assessment with integrated material flow costing.

By simulating and visualizing material flow networks, the software analyses a company's production processes and all associated material and energy flows. The results can then be evaluated according to both conventional and material flow cost accounting.